Please refer to important disclosures at the end of this report

1

Sona BLW Precision Forgings (Sona Comstar), a technology and innovation driven

company, derives ~40% of its revenues from high growth areas like Battery Electric

Vehicles (BEV) and Hybrid Vehicles. It is among the top 10 players globally for

differential bevel gears and for starter motors for the PV segment. It had 5% market

share for differential bevel gears, 3% for starter motors and 8.7% for BEV

differential assemblies. They have a diversified customer base across the globe with

75% of their income (sale of goods, FY21) coming from end-use in overseas markets.

Positives: (a) One of the leading manufacturers and suppliers to global EV markets

(b) One of the leading global companies and gaining market share, diversified

across key automotive geographies, products, vehicle segments and customers (c)

Strong research and development and technological capabilities in both hardware

and software development (d) Strong business development with customer centric

approach. (e) Consistent financial performance with industry leading metrics.

Investment concerns: (a) Business is dependent on the performance of the

automotive sector globally, including key markets such as US, Europe, India, and

China. (b) Negative publicity about the brand, or inability to protect any of the IPs,

including misappropriation, infringement could impact the business. (c) Business

largely depends upon the top ten customers and the loss of such customers or a

significant reduction in purchases by such customers will have a significantly

adverse impact on the business.

Outlook & Valuation: Sona Comstar is present in the right areas and can be a

major beneficiary of shift in focus of Global OEM’s towards EVs over the next

decade. As per industry reports, Sona Comstar is among handful of companies in

the world with strong motor and driveline capabilities. We believe that the company

can maintain strong growth rates from its current base given higher salience of

revenues from BEVs vs. industry. Ramp-up of business by select Global OEMs with

EV offerings provides evidence while increasing avg. realization per vehicle (ICE vs.

BEV) would drive top-line growth. The upper end of ` 291 implies FY21 P/E of

~75.2x which is in line with other Indian Auto Component companies that have

lower top-line growth, margins and return ratios vs. Sona Comstar. Hence, we

recommend “SUBSCRIBE” on the Issue.

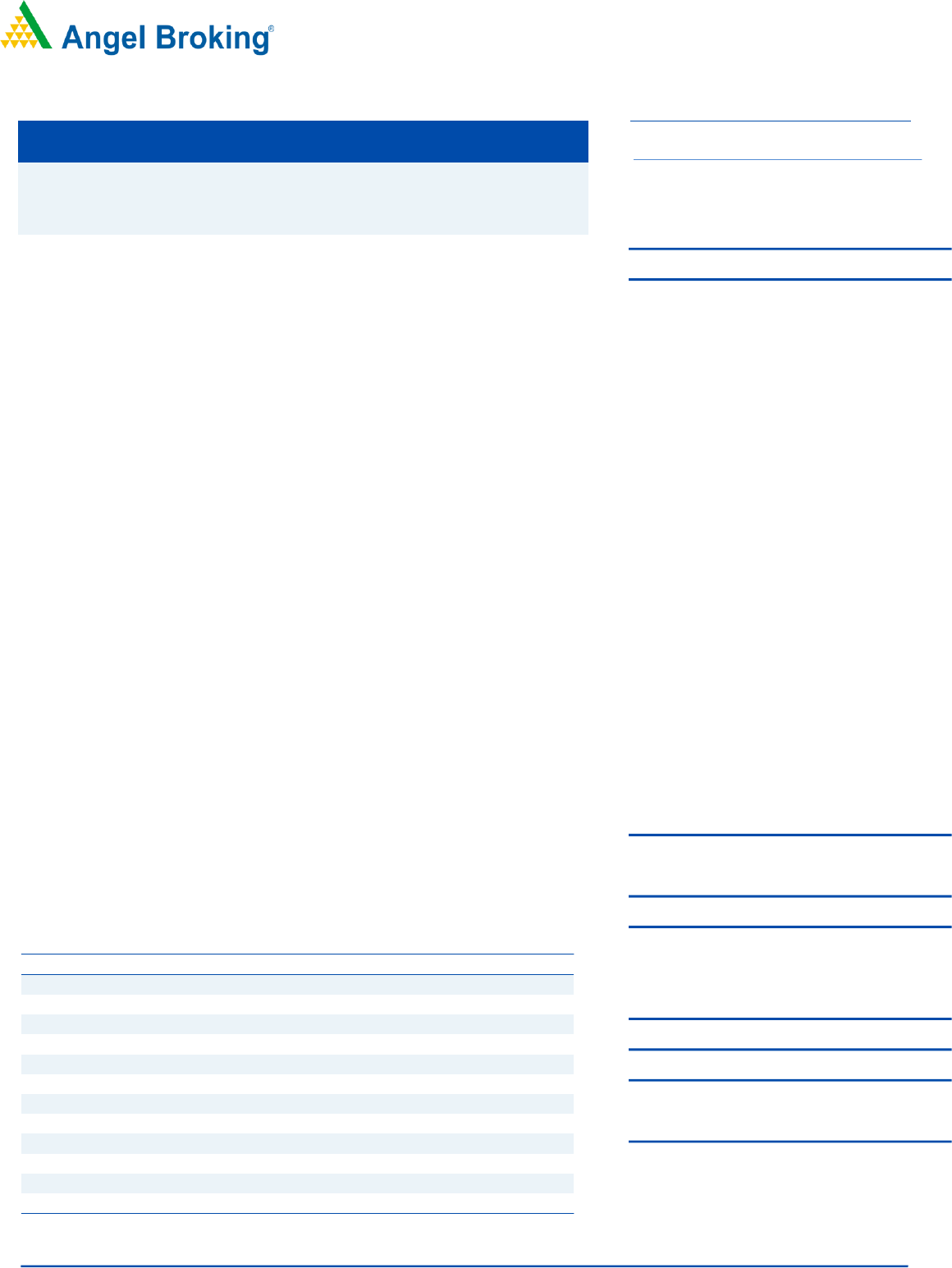

Key Financials

Y/E March (` cr)

FY2019

FY2020

FY2021

Net Sales

699.2

1,038.0

1,566.3

% chg

-

48.4

50.9

Net Profit

173.2

360.3

215.2

% chg

-

108.1

-40.3

EBITDA (%)

28.6

23.3

28.2

EPS (Rs)

62.5

75.5

3.8

P/E (x)

4.7

3.9

77.5

P/BV (x)

4.6

1.2

12.8

ROE (%)

99.7

30.6

16.5

ROCE (%)

53.2

10.9

18.9

EV/EBITDA

4.6

6.4

38.4

EV/Sales

1.3

1.5

10.8

Source: Company, Angel Research

SUBSCRIBE

Issue Open: June 14, 2021

Issue Close: June 16, 2021

Offer for Sale: Rs. 5250cr

QIBs 75% of issue

Non-Institutional 15% of issue

Retail 10% of issue

Promoters 67.3%

Others 32.7%

Fresh issue: Rs. 300 cr.

Issue Details

Face Value: Rs 10

Present Eq. Paid up Capital: Rs 573.0 cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: Rs 583.3 cr

Issue size (amount): Rs 5550 cr

Price Band: Rs 285-291

Lot Size: 51 shares and in multiple thereafter

Post-issue mkt. cap: *Rs 16630 cr - **Rs 16974 cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 67.3%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Sona BLW Precision Forgings Limited

f

IPO Note

June 11, 2021

Sona Comstar Ltd | IPO Note

June11, 2021

2

Company background

Incorporated in October 1995, Sona BLW Precision Forgings Limited is one of

India’s leading automotive technology companies, designing, manufacturing, and

supplying highly engineered, mission critical automotive systems and components.

Its components include differential assemblies, differential gears, conventional and

micro-hybrid starter motors, BSG systems, EV traction motors (BLDC and PMSM)

and motor control units. It supplies its automotive OEMs across US, Europe, India,

and China, for both electrified and nonelectrified powertrain segments. Company

has been gaining global market share across products to reach a share of

approximately 5.0% for differential bevel gears, 3.0% for starter motors and 8.7%

for BEV differential assemblies, in calendar year 2020. It has nine manufacturing

and assembly facilities across India, China, Mexico, and USA, of which six are in

India, from where it supplies products to six out of the top ten global PV OEMs,

three out of the top ten global CV OEMs and seven out of the top eight global

tractor OEMs by volume.

It is a technology and innovation driven company. With a strong focus on research

and development (“R&D”), it is among one of a few companies globally, with the

ability to design high power density EV systems handling high torque requirements

with a lightweight design, while meeting stringent durability, performance and

NVH specifications, enabling EV manufacturers to enhance the vehicle range,

acceleration, and the overall efficiency.

Its total operating income has grown at a CAGR of 10.9% from Fiscal Years 2016

to 2020, as compared to the average CAGR of 8.1% for the top ten listed auto-

component manufacturers in India. For Fiscal Years 2019, 2020 and 2021, it has

EBITDA of ₹4,122.43 million, ₹3,253.55 million, and ₹4,410.16 million

amounting to EBITDA margin of 28.9%, 26.7% and 28.2%, respectively, average

ROE of 35.6%, 35.2% and 36.4%, respectively, and ROCE of 40.3%, 29.0% and

34.8%, respectively.

Issue details

The issue size is ` 5550cr, which comprises of fresh issues of up to `300 crore &

offer for sale of ` 5250cr in the price band of `285-`291 per share.

Pre and post IPO shareholding pattern

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

57,29,80,560

100.0

39,25,68,189

67.3

Public

0

0.0

19,07,21,649

32.7

Total

57,29,80,560

100.0

58,32,89,838

100.0

Source: Company, Angel Research & RHP.

Objectives of the Offer

Repayment and pre-payment of identified borrowings in full availed by the

Company; and

General corporate purposes

Sona Comstar Ltd | IPO Note

June11, 2021

3

Key Management Personnel

Sunjay Kapur is the Chairman and Non-Executive Director of the Company. He

holds a bachelor’s degree in science (business studies) from the University of

Buckingham. He has over 21 years of experience in the automotive industry. He

also served as director on the board of directors of various companies and was the

managing director of Sona Koyo Steering Systems Limited (now JTKET India

Limited).

Vivek Vikram Singh is the Managing Director and Group Chief Executive Officer of

the Company. He holds a bachelor’s degree in technology (computer science and

engineering) from HBTI, Kanpur and a post graduate diploma in management

from the Indian Institute of Management, Ahmedabad. He has over 15 years of

experience, including six years of experience in the automotive industry

Amit Dixit is a Nominee Director of the Company. He holds a bachelor’s degree of

technology in civil engineering from the Indian Institute of Technology, Bombay,

(where he was awarded the institute silver medal) a master’s degree in science in

civil engineering from the Leland Stanford Junior University and a master’s degree

in business administration from Harvard University. He has significant experience

in various investments and investment opportunities in India and South Asia.

Ganesh Mani is a Nominee Director of the Company. He holds a bachelor’s

degree of technology in mechanical engineering from the Indian Institute of

Technology, Bombay. He is currently managing director with the private equity

business group of the Blackstone Group in India.

Sona Comstar Ltd | IPO Note

June11, 2021

4

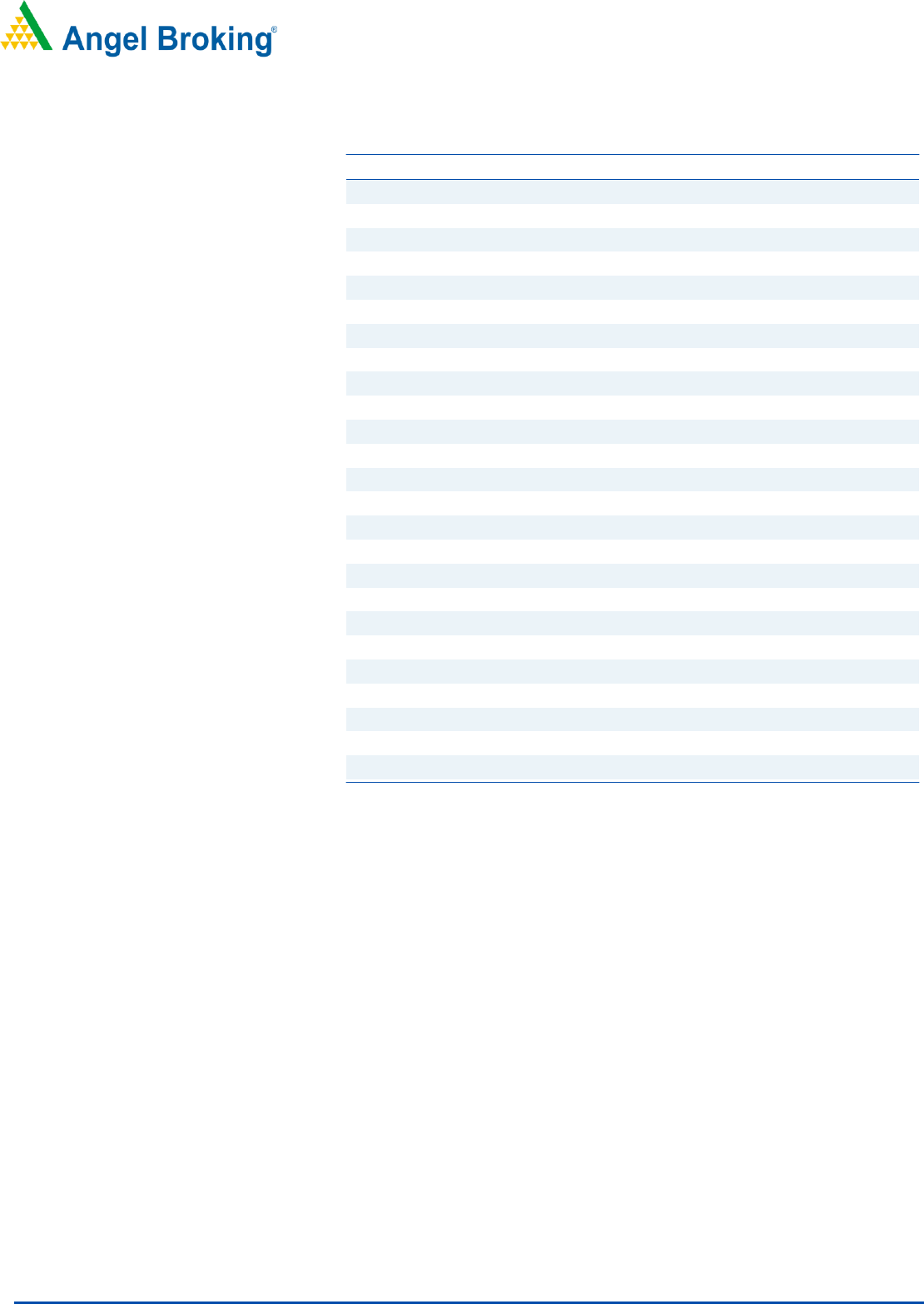

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2019

FY2020

FY2021

Total operating income

699.2

1,038.0

1,566.3

% chg

-

48.4

50.9

Total Expenditure

499.2

795.7

1,125.3

Cost of materials consumed

192.84

442.42

709.48

Changes in inventories & WIP

12.22

3.18

-64.17

Employee benefits expense

49.00

102.73

147.45

Other expenses

245.17

247.38

332.53

EBITDA

200.0

242.3

441.0

% chg

-

21.1

82.0

(% of Net Sales)

28.6

23.3

28.2

Depreciation& Amortization

31.0

67.1

96.9

EBIT

169.0

175.2

344.1

% chg

-

3.6

96.4

(% of Net Sales)

24.2

16.9

22.0

Finance costs

17.8

26.0

32.5

Other income

76.6

5.8

2.3

(% of Sales)

10.9

0.6

0.1

Recurring PBT

227.8

155.0

313.9

% chg

-

-32.0

102.6

Exceptional item

-

232.1

-13.9

Tax

54.6

26.7

84.8

PAT (reported)

173.2

360.3

215.2

% chg

-

108.1

-40.3

(% of Net Sales)

24.8

34.7

13.7

Basic & Fully Diluted EPS (`)

62.5

75.5

3.8

Source: Company, Angel Research

Sona Comstar Ltd | IPO Note

June11, 2021

5

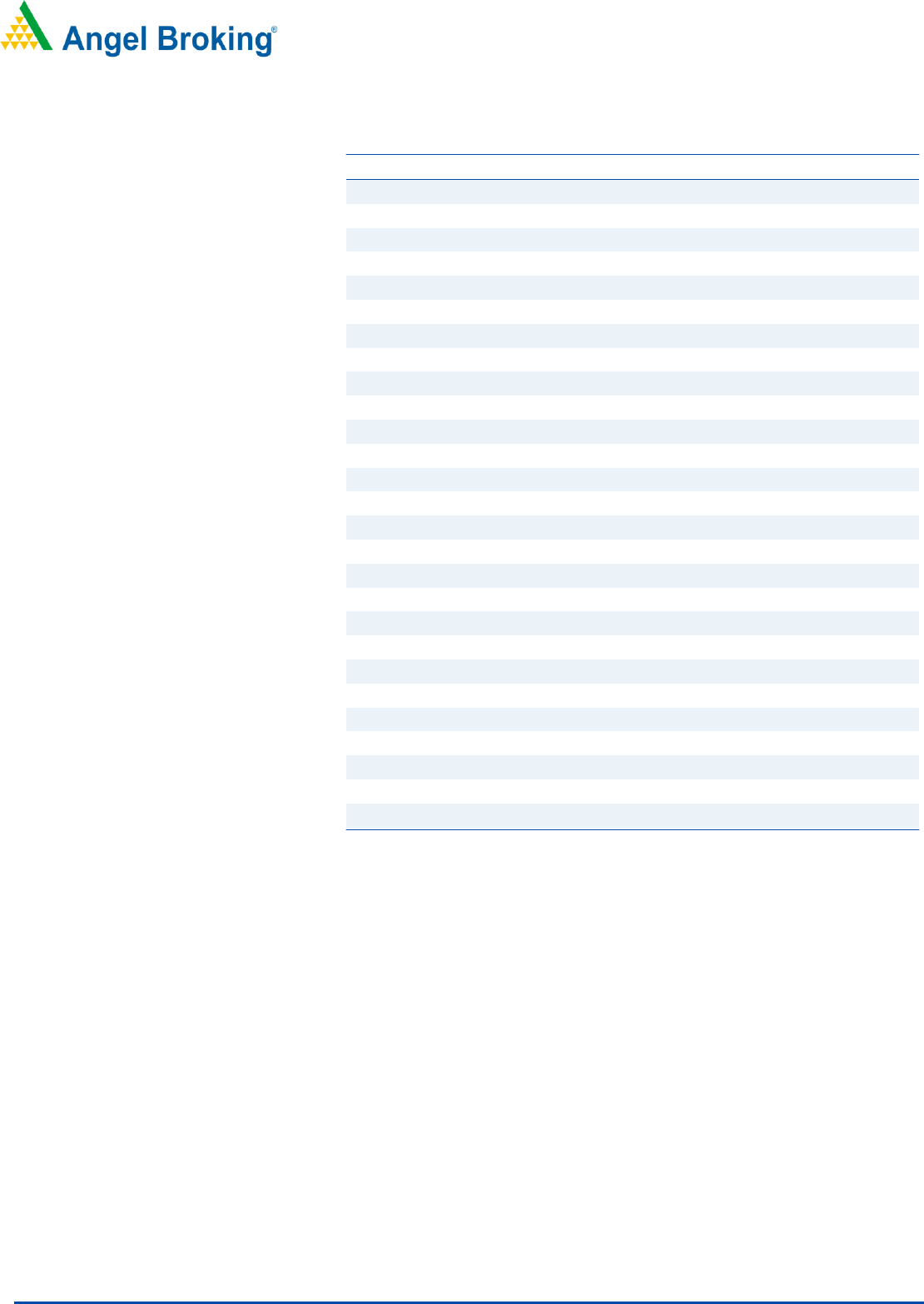

Consolidated Balance Sheet Statement

Y/E March (` cr)

FY2019

FY2020

FY2021

SOURCES OF FUNDS

Equity Share Capital

27.7

47.7

573.0

Other equity (Retained Earning)

146.1

1,130.2

730.9

Shareholders’ Funds

173.8

1,177.9

1,303.9

Total Loans

114.6

261.4

305.2

Other liabilities

29.2

167.7

206.8

Total Liabilities

317.7

1,607.1

1,815.9

APPLICATION OF FUNDS

Property, plant and equipment

178.4

284.5

344.9

Capital work-in-progress

13.2

58.1

82.1

Right-of-use assets

40.5

141.9

159.3

Goodwill

-

175.8

175.8

Other intangible assets

72.4

462.9

536.6

Intangible assets

-

31.5

1.1

Current Assets

1,312.5

631.8

820.9

Inventories

67.8

196.2

305.6

Trade receivables

152.1

233.6

417.0

Cash and cash equivalents

0.2

105.0

24.9

Bank balances

25.4

62.3

2.6

Loans

0.0

0.5

1.5

Other financial assets

3.2

0.5

15.2

Other current assets

13.0

33.6

54.2

Asset for Disposal

1,050.7

-

-

Current Liability

1,314.9

243.6

358.9

Net Current Assets

-2.4

388.2

462.1

Other Non-Current Asset

15.7

64.1

54.1

Total Assets

317.7

1,607.1

1,815.9

Source: Company, Angel Research

Sona Comstar Ltd | IPO Note

June11, 2021

6

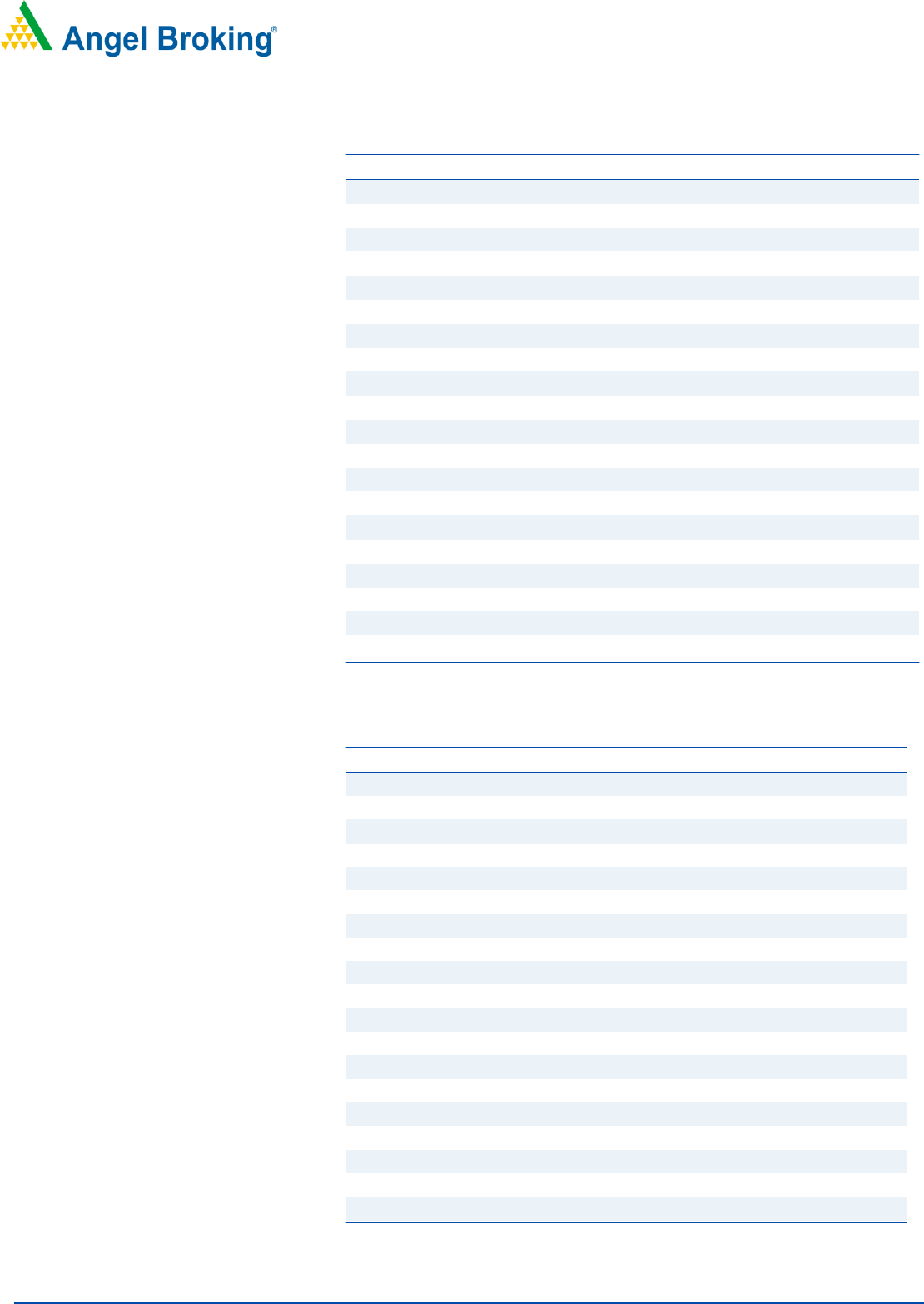

Consolidated Cash flow

Y/E March (`cr)

FY2019

FY2020

FY2021

Operating profit

200.89

264.77

402.59

Net changes in working capital

43.68

16.38

-207.05

Cash generated from operations

244.6

281.2

195.5

Direct taxes paid (net of refunds)

-49.41

-27.81

-52.82

Discontinued operations

-40.56

0.00

0.00

Cash flow from operating activities

154.6

253.3

142.7

Payments for acquisition

-141.769

-212.06

-218.937

Proceeds from sale

0.367

0.119

0.907

Others

(21.9)

(742.3)

62.0

Cash Flow from Investing

204.1

(954.2)

(156.1)

Proceeds from short term borrowings

3.959

25.699

29.852

Proceeds from long term borrowings

34.318

160.755

71.757

Repayment of long term borrowings

-53.476

-37.366

-40.797

Repayment of deferred payment

-0.157

-8.642

-1.247

Repayment of lease liabilities

-2.331

-5.688

-9.134

Others

-16.019

632.066

-117.13

Cash Flow from Financing

(346.1)

766.8

(66.7)

Inc./(Dec.) in Cash

12.6

66.0

(80.0)

Opening Cash balances

26.4

39.0

105.0

Closing Cash balances

39.0

105.0

24.9

Source: Company, Angel Research

Key Ratios

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

4.7

3.9

77.5

P/CEPS

4.0

3.3

53.4

P/BV

4.6

1.2

12.8

EV/Sales

1.3

1.5

10.8

EV/EBITDA

4.6

6.4

38.4

Per Share Data (Rs)

EPS (Basic)

62.5

75.5

3.8

EPS (fully diluted)

62.5

75.5

3.8

Cash EPS

73.6

89.5

5.4

Book Value

62.7

246.7

22.8

Returns (%)

ROE

99.7

30.6

16.5

ROCE

53.2

10.9

18.9

Turnover ratios (x)

Receivables (days)

79.4

82.2

97.2

Inventory (days)

35.4

69.0

71.2

Payables (days)

-

-

-

Working capital cycle (days)

114.8

151.2

168.4

Source: Company, Angel Research

Sona Comstar Ltd | IPO Note

June11, 2021

7

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.